Embarking on the journey towards financial stability can feel overwhelming, but it doesn't have to be. By implementing a well-structured plan and adopting sound financial habits, you can pave the way for a secure future. Here's a step-by-step here guide to help you unlock financial stability:

- Assess your current financial situation by tracking your income, expenses, and debts.

- Create a comprehensive budget that outlines your monthly income and expenditure.

- Cultivate an emergency fund to cover unexpected expenses and protect you from financial setbacks.

- Research various investment options to grow your wealth over time.

- Reduce your debt responsibly by making timely payments and exploring strategies for debt consolidation or repayment.

By diligently following these steps, you can gain control of your finances, reduce stress, and achieve lasting financial stability.

Taming Your Finances

Building a solid financial future starts with setting achievable goals. Instead of focusing on vague dreams like becoming a millionaire, break down your aspirations into manageable steps. For example, instead of "I want to be wealthy," aim for "I will save 15% of my income each month." This approach makes your goals feel less intimidating and more achievable . Once you've established your objectives, create a comprehensive plan that outlines the steps you need to take to achieve them.

Consider using a budget tracker to monitor your spending and identify areas where you can cut back . Explore various investment options to grow your wealth over time. Remember, consistency is key. Even small actions taken regularly can have a significant impact on your financial well-being in the long run.

Effective Saving Techniques for All Income Levels

Building wealth doesn't have to be. It all starts with establishing effective saving strategies that fit your financial situation. Whether you're just starting out, there are practical tips to help you build a secure financial future.

It's important to understand where your money goes so you can allocate funds wisely. Once you have a clear picture of your finances, you can start implementing saving strategies that are tailored to your needs.

Determine how much you can comfortably save each month.

Consider seeking advice from a financial advisor to help grow your wealth faster.

Remember, even small amounts saved regularly can add up over time. Be patient, and you'll be well on your way to building a strong financial foundation.

Achieving Your Dreams: A Guide to Smart Saving

Do you yearn for a life filled with experiences? It's within your grasp! But before you embark on that exciting path, it's essential to master the skill of saving money. Creating a strong financial foundation is the key to empowering your dreams and living life on your own terms.

Saving money doesn't have to be draining. In fact, it can be an incredibly liberating experience when you consider it as a strategic vehicle for your future. With the right mindset and techniques, you can transform your finances and set yourself up for long-term achievement.

- Adopt a budgeting plan that works for you.

- Identify areas where you can minimize your spending.

- Explore creative ways to earn extra income.

Remember, every penny saved is a step closer to achieving your dreams. So welcome this journey of financial independence and watch as your aspirations unfold.

Financial Freedom Starts Now: Simple Steps to Secure Your Future

The path towards fiscal freedom doesn't need to be a daunting climb. It starts with small, regular steps that you can take today. Forming a solid financial foundation is about more than just accumulating money; it's about making informed decisions that will guarantee your future. One of the most essential things you can do is to establish a practical budget. This involves observing your earnings and expenses. By understanding where your money goes, you can identify areas where you can reduce spending and direct more funds towards your financial goals.

, Moreover, it's crucial to start investing as early as possible. Even small, regular contributions can multiply over time thanks to the power of compound interest. Explore different investment options and choose those that align with your risk tolerance and financial objectives. Remember, investing isn't just about making money; it's about building a secure and wealthy future for yourself.

Finally, enhance yourself about personal finance. There are many materials available to help you grasp key concepts such as budgeting, investing, and debt management. By continuously learning and adapting your financial strategies, you can enhance your chances of achieving absolute financial freedom.

Dominate Debt and Craft a Solid Financial Foundation

Taking control of your finances is essential for achieving your dreams. One of the most effective ways to strengthen your financial position is by addressing debt. A solid financial foundation facilitates you to implement informed decisions and attain your long-term targets.

- Develop a detailed financial plan to track your income and outgoings.

- Recognize areas where you can cut spending.

- Consider loan refinancing to reduce your interest rates and monthly payments.

Commit to making extra income through a part-time job. This can expedite your debt reduction journey.

Marla Sokoloff Then & Now!

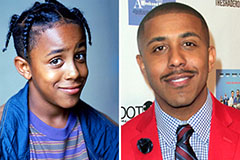

Marla Sokoloff Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!